pay outstanding excise tax massachusetts

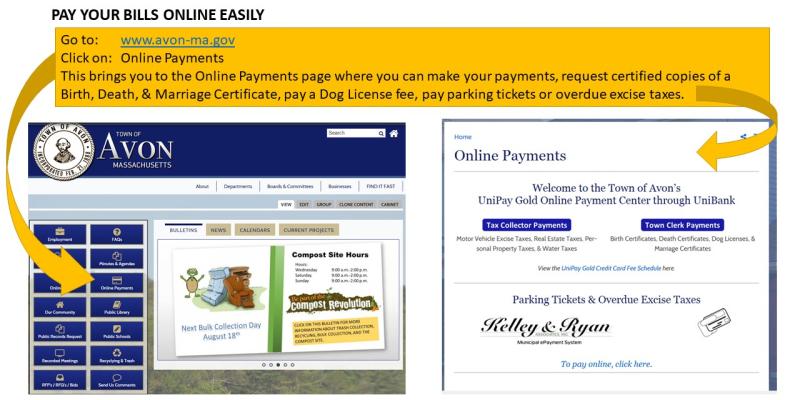

For your convenience payment can be made online through their website. If you are currently on registry hold and all your outstanding excise tax bills are.

Motor Vehicle Excise Taxes Royalston Ma

Drivers License Number Do not enter vehicle plate numbers.

. If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. If you are unable to find your bill try searching by bill type. What happens if you dont pay excise tax.

If you are not registered for MassTaxConnect but. The Town mails motor vehicle excise bills to registered owners once a year or after a change in registration. Pay Delinquent Excise.

How often do you pay excise tax in MA. It needs to pay in 4 installments the. The charge for a demand bill is 500.

Paying online reduces paper use and is an easy way to help the environment. Tax payments can be made on MasstaxConnect with. Excise tax bills are due annually for every vehicle owned and registered in Massachusetts.

All corporations that expect to pay more than 1000 for the corporate excise tax have to make estimated tax payments to Massachusetts. Your credit card for a fee or. The collector will send a demand.

This can take up to 90 days. You must file for abatement with the Athol Assessors office if you are entitled to abatement. The excise tax rate is 25 per 1000 of assessed value.

The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax. ACH debit from checking or savings account. The demand fee is 5.

After 30 days a. If an excise tax is not paid within 30 days from the assessors mailing date. If you dont make your payment within 30 days of the date the City issued the excise.

Interest accrues on the overdue bill from the day after the due date until. Excise tax bills are prepared by the Registry of. Payments are due 30 days from the date of issue of the bill.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Massachusetts imposes a corporate excise tax on certain businesses. You must pay the excise tax bill in full by the due date.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. If an excise is not paid within 30 days from the date of issue a demand bill is sent. Further collection includes the issuance of both a 1st and 2nd warrant notice and the marking of the outstanding motor vehicle excise tax bill at the Massachusetts Registry of Motor Vehicles.

If youre making a credit card payment regarding a bank or wage levy you must contact us at 617 887-6367. The assessed value is based on the manufacturers suggested retail price and depreciated for five years. Tax information for income tax purposes must be requested in writing.

Find your bill using your license number and date of birth. We recommend keeping a copy of the confirmation number with your tax records. 98 Cottage Street Easthampton MA 01027 413-527-2388 413-529-0924 Fax.

Corporate excise can apply to both domestic and foreign corporations. The minimum excise tax.

Massachusetts Motor Vehicle Excise Tax Law

Massachusetts Tweaks Tax Policies For A Future Including Covid 19

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Motor Vehicle And Boat Tax Boston Gov

Massachusetts Used Car Sales Tax Fees

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Avoid Potential Motor Vehicle Excise Penalties Interest And Fees Lawrence Ma

Car Rental Taxes Reforming Rental Car Excise Taxes

Wtf Massachusetts R Massachusetts

Overdue Excise Tax Warrants Acushnet Ma

Jeffery Jeffery Deputy Tax Collectors Massachusetts

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Search Results For Excise Tax City Of Revere Massachusetts

The Springfield Youth Mental Health Coalition Seeks Feedback Through Youth Voice Survey City Of Springfield Ma

Canadian Cannabis Producers Overdue Excise Taxes More Than Triple To Ca 52 Million

Excise Taxes Excise Tax Trends Tax Foundation

Wtf Massachusetts R Massachusetts

Springfield Excise Tax Bills For Dealer And Repair Plates Not Mailed For Years Masslive Com